Novel insights on the economic contribution of the potato sector

The Project

The Project

A working group of potato industry representatives, government officials and academics was established to identify a strategy and key recommendations for dealing with PCN in Scotland. Following recommendations from the Scottish PCN Working Group (2020) to the Scottish Government, funding was awarded to a 5-year project of scientific research and knowledge exchange with an aim to deliver a sustainable potato and bulb industry for Scotland through the management of PCN. The project is led by the Plant Health Centre, and involves other organisations including the James Hutton Institute, SRUC, SoilEssentials, Scottish Agronomy and SASA who are all working together to deliver nine core work packages.

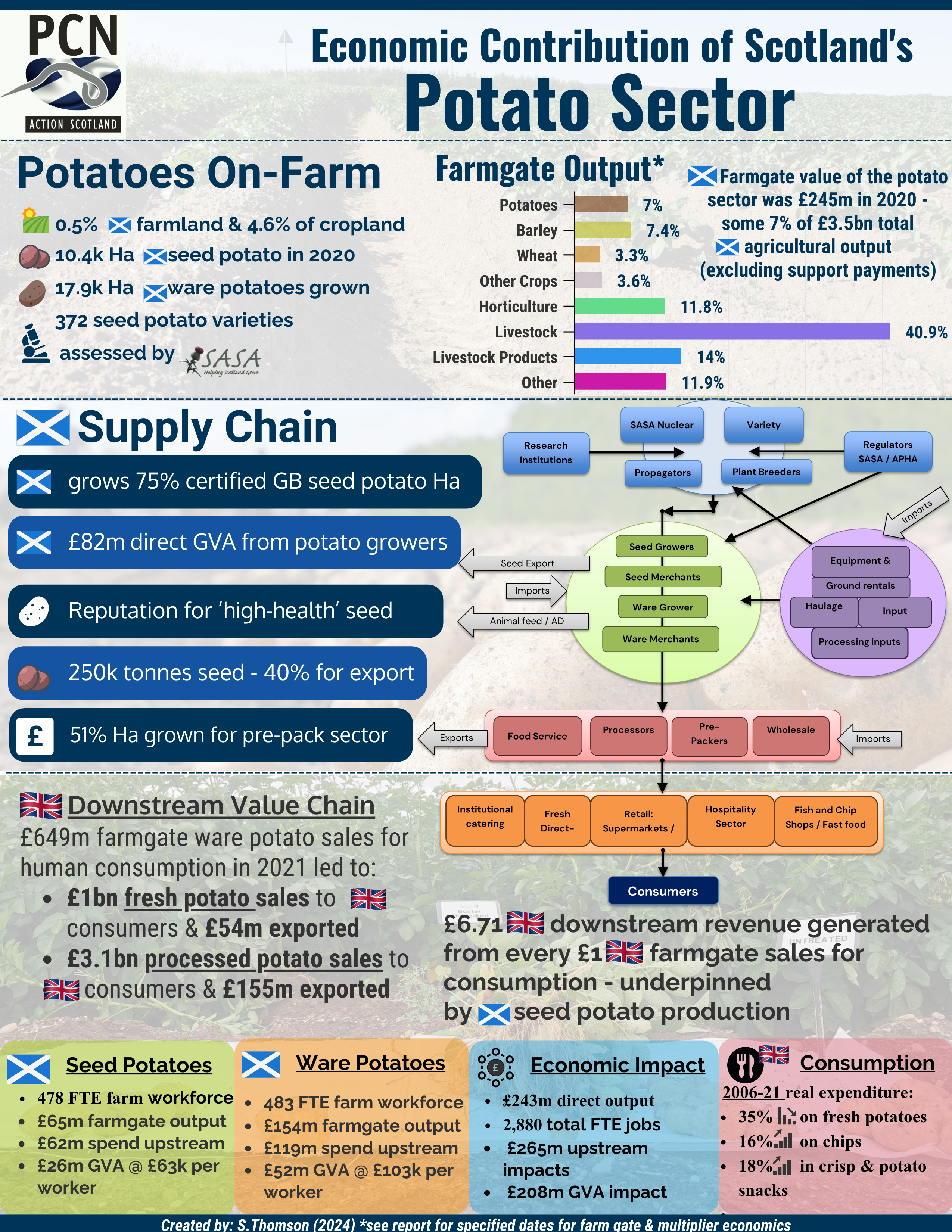

This report is part of Work Package 1: Economic Contribution of the Scottish Government funded research project: Delivering a sustainable potato industry for Scotland through management of Potato cyst nematode (PCN). As part of this workstream this report aims to provide new insights into the economic contribution that the Scottish potato sector makes beyond the often cited farmgate value of potato production. This report provides a statistical overview of this concentrated and highly regulated sector, including data on consumption, exports, imports, production, varieties, seed and ware sector – alongside estimates of economic contribution.

The Report

The report (which can be downloaded here) provides evidence on the Scottish, Great Britain and UK potato sectors, including:- Long term potato consumption trends in the UK as the main driver of demand for Scottish potatoes.

- An overview of UK and GB potato production- including markets, varieties grown, prices, imports and exports.

- Insights on Scotland’s potato sector, including details about seed potato development and growers (including varieties and royalties), the potato growing regions of Scotland (and the demand for clean ground), markets for Scottish seed and ware potatoes as well as insights on crop protection products used.

- Methods and data used to estimate the economic contribution of the potato sector - how economic multipliers derived from input-output tables are used to estimate the upstream economic contribution derived from expenditure made by potato growers.

- Results and estimates of backward economic contributions within the supply chain of the potato sector and consideration of the the value chain from farm to fork - looking at downstream processing, retail and hospitality and final consumption data across the UK and Scotland.

The Results

- Scottish on-farm potato growing was estimated to generate £242m in revenue, with £44m retained profit, and direct labour costs of £34m (with £4m SASA labour costs). It was estimated that 1,041 FTE jobs were directly created by the potato growing sector (558 attributable to the seed sector) – with 961 FTE jobs on farm, with a further 80 FTEs through publicly funded SASA staff. The Gross Value Added (GVA) generated directly from Scottish potato growers amounted to £78.3m (average 2017-2021). Of that £26.2m was attributable to seed potato growing and £52.1m to ware potato growing.

- Potato growers (plus SASA and public research and development running costs) were estimated to have spent £168.6m on upstream input goods and services. This led to further indirect and induced multiplier effects along input supply chains of a further £101m. Thus, potato growers upstream total economic impacts amounted to an estimated £265m (£105m from the seed sector expenditure). The upstream spend stimulated 1,839 FTE jobs (731 FTEs arising from seed sector expenditure) after indirect and induced impacts were considered. The GVA attributed to the upstream multiplier effects from potato growers expenditure amounted to £126m (£50m from the seed sector).

- Overall, the Scottish potato sector had an on-farm and upstream economic contribution of £507m output, accounted for 2,880 FTE jobs and contributed £208m to Scottish GVA.

- In addition, downstream parts of the supply-chain process, distribute and sell on the £242m of farmgate output. This incurs additional costs but also adds additional value, culminating in eventual sales to consumers, and generates employment. However, attributing specific elements of these downstream effects to on-farm production in Scotland is difficult due to the complexity of supply-chains and the opaqueness of business reporting. The complex nature of economic impacts are further complicated as Scotland grows 75% of GB's certified seed potato area - seed potatoes that underpin potatoes grown for consumption (ware) across GB and internationally. Nonetheless, it is estimated that across the UK each £1 of farmgate sales is associated with £6.71 of downstream revenue. This implies that Scottish on-farm production of £242m contributes towards £1.6bn of downstream revenues, although not all of this will necessarily be within Scotland.